Explore how tariffs function, how the U.S., China, UK, India, and others are using them in 2025, and why today’s trade battles are reshaping global technology, prices, and economic growth.

What Exactly Is a Tariff?

At its simplest, a tariff is a tax that a government places on products coming into the country from abroad. The idea is straightforward: if a pair of steel beams, a smartphone, or a bag of soybeans crosses the border, the importing country tacks on an extra fee. That added cost makes the imported item more expensive when it reaches domestic consumers or industries.

Governments typically use tariffs for three main reasons:

- Shielding local industries from cheaper foreign competitors.

- Boosting government revenue (though this is less important today than in earlier centuries).

- Flexing political or economic power in disputes or negotiations.

Tariffs are as old as trade itself, but their purpose has shifted. In the 21st century, tariffs are less about filling treasuries and more about strategic competition and few rivalries illustrate that better than the ongoing U.S.–China struggle, along with escalating tensions involving the EU, UK, and India.

The 2025 Tariff Battleground: Escalations and Truces

The year 2025 has seen tariffs take center stage again, building on Trump-era policies and pushing them further. The back-and-forth has resembled a chess match with more knights charging than pawns moving fast, unpredictable, and costly.

Some highlights from this year’s developments:

- April 2, 2025: President Trump declared a national emergency, raising tariffs on Chinese imports to as high as 125% under “reciprocal tariff” policies.

- May 30, 2025: Duties on steel and aluminum doubled, now at 50%, affecting suppliers from China to the EU.

- July 31, 2025: Executive Order 14257 modified tariff schedules again, targeting countries with large trade surpluses.

- August 7, 2025: Reciprocal tariffs fully implemented. China shot back, raising its duties on American goods to 84%.

- August 11–12, 2025: Washington and Beijing agreed to pause further hikes for 90 days, delaying the next round of tariffs until November 10.

- August 15, 2025: U.S. slashed certain Chinese tariffs from 145% down to 30% to advance trade talks. (For context: Chinese duties on U.S. goods briefly peaked near 147.6% in April before easing.)

- Late August 2025: Tensions spread beyond Asia. The U.S. imposed new 50% tariffs on Indian goods, doubling from previous 25% levels, as punishment for India’s Russian oil purchases and export surpluses. The measure hit roughly $48 billion of Indian exports, from textiles to machinery.

Meanwhile, the EU explored tariff rollbacks to mend relations, while post-Brexit UK secured a modest 10% U.S. tariff rate, currently the lowest negotiated.

The shifting rules leave businesses, investors, and governments in a near-constant state of guesswork: Will this dance of escalation and de-escalation calm down after November, or flare into something larger?

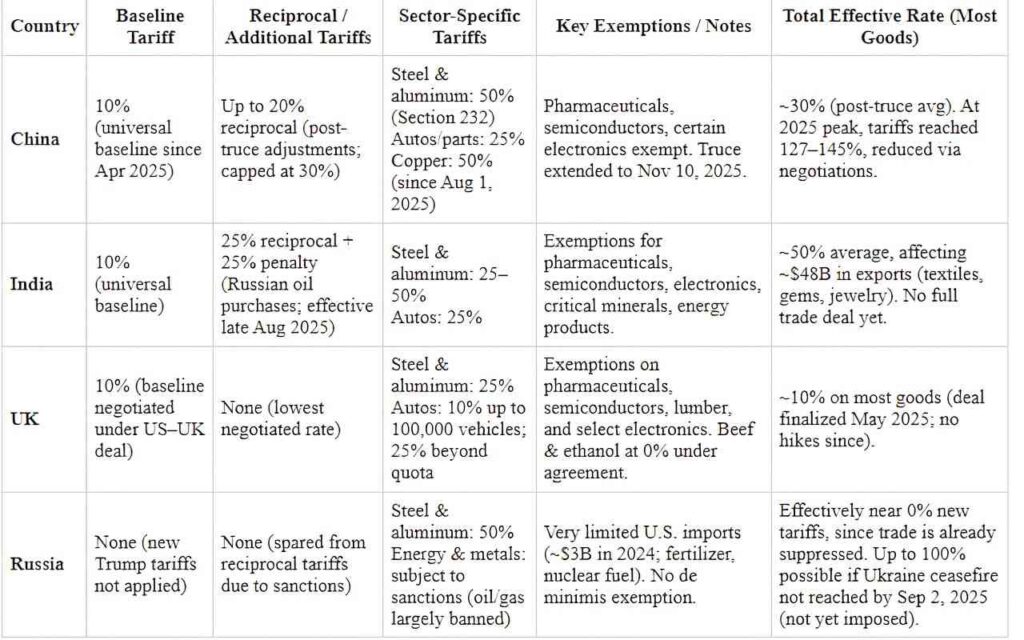

US Tariff List on Selected Countries as of September 2025 Top 4

Tariffs in Action: Country Snapshots

United States

- China: Peak tariffs reached 125%+ on imports, later rolled back under truces to 10–30%. Targets include steel, electronics, and solar panels.

- European Union: Ongoing tariffs on metals and luxury goods, with disputes tied to aircraft subsidies still unresolved.

- UK: Lowest negotiated rate at 10%, mostly on cars and machinery.

- India: Major flashpoint tariffs raised to 50% on goods worth $48B, sparking anxiety over bilateral trade.

- Russia & Saudi Arabia: Mix of sanctions and limited tariffs on energy and petrochemical products.

China’s Counterpunch

China has answered in kind. At its peak, it imposed tariffs averaging 147.6% on $110B of U.S. exports. Key targets? Agricultural products like soybeans and corn, cars, and high-tech equipment. The most visible effect has been a permanent reordering of global food trade: China shifted long-term soybean sourcing to Brazil, cutting into U.S. farmers’ dominance.

Tariff on India

India has avoided large retaliatory tariffs so far but is doubling down on trade diversification. New focus markets include the UK, Japan, and Southeast Asia. The government insists on resilience, noting that higher tariffs may erase much of the savings India enjoyed from discounted Russian oil.

UK & EU

- UK: Applies independent tariffs post-Brexit, including duties on Chinese steel. Exploring carbon border adjustments for climate policy enforcement.

- EU: Maintains steel/aluminum tariffs and retaliatory measures, particularly in disputes with the U.S. about aircraft subsidies.

- UK Parliament

The Real-World Effects: Industry and Technology

Tariffs may look like abstract numbers in trade tables, but their bite is very real.

- Higher Consumer Costs: In 2025, tariffs cost U.S. households an estimated $2,400 more per year in higher prices for everyday goods steel beams, kitchen appliances, cars, electronics.

- Technology Slowdowns: Tariffs on Asian chips and rare earth minerals ripple into AI, electric vehicles, green energy, and electronics, delaying innovation and raising costs.

- Market Rewiring: From soybeans to semiconductors, countries are rearranging supply chains, often permanently. Brazil, Vietnam, and Mexico have gained ground as alternatives to U.S. suppliers.

- Jobs and Growth: While tariffs can shelter some domestic industries in the short term, the bigger picture shows strain. In the U.S., analysts estimate 641,000 fewer jobs and annual losses of $135B in 2025 due to trade frictions. In India, millions of textile and manufacturing workers face uncertainty.

Looking Ahead: Projections Through 2030

If current tariff battles persist, economists warn of a drag on growth into the next decade:

- Global GDP could shrink by 1.1% by 2030.

- U.S. growth may decline 0.2–0.6 points in 2025–26, with inflation spikes near 1.8%.

- Technology sectors could lose up to 553,000 jobs, slowing investment in semiconductors, EVs, and AI.

- Supply chains may continue permanently shifting away from the U.S. toward ASEAN countries, diversifying trade flows.

For U.S.–India ties in particular, prolonged 50% tariffs risk erasing up to $48B per year in Indian exports, ironically pushing India to accelerate diversification and potentially strengthen its long-term economic independence.

FAQ:

Which country has imposed the most tariffs on the U.S.?

China, with duties peaking at 147.6% on over $110B of imports.

How do U.S. tariffs affect India?

The 50% rate on Indian goods threatens $48B in exports, wiping out Russian oil savings and putting major textile and agricultural sectors at risk.

Tariff vs. Tax ,what’s the difference?

A tax is collected internally from citizens and businesses. A tariff is charged externally, specifically on imports or exports crossing a border.

Is there a solution?

Resolutions usually require bilateral deals, WTO arbitration, or compromises like 90-day tariff truces. Still, fragile truces are not the same as lasting peace.

Final Thoughts

Tariffs today are less about taxes and more about leverage in a high-stakes global contest. The U.S.–China rivalry dominates the narrative, but the widening rift with India underscores that trade wars rarely stay in tidy boxes. For households, this means higher living costs. For industries, it brings inflation and bottlenecks. For global technology, it risks slowing the breakthroughs that drive modern growth.

The takeaway: tariffs can protect domestic jobs in the short run, but at the cost of higher global instability, weaker innovation, and disrupted supply chains. Unless de-escalations solidify, the world economy could be looking at slower growth well into the 2030s .where the winners may not be those who impose the highest tariffs, but those who adapt supply chains the fastest.

Note: The information provided was last updated on 02/09/2025. Future updates or changes may occur after this date.

Top 10 Programming Languages in Demand Now and in the Future

Russia Claims Testing First AI-Powered mRNA Cancer Vaccine in 2025

All content is based on: